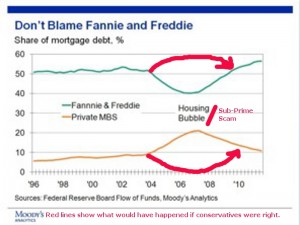

How to tell Conservatives are lying about the housing bubble.

I modified Mark Zandi’s chartto add what would have happened if conservatives were right about the causes of the housing bubble. Frannie’s and Freddie’s market share would have gone up, while private firms’ share would have gone down.   Blaming FF is not only dishonest, but it prevents us from stopping future scams. If conservatives succeed in pointing a finger at public institutions, private firms will be free to resume predatory practices.

There is plenty of blame to go around for the U.S. housing bubble, but not much of it belongs to Fannie Mae and Freddie Mac. The two giant housing-finance institutions made many mistakes over the decades, some of them real whoppers, but causing house prices to soar and then crater during the past decade weren’t among them….

The biggest culprits in the housing fiasco came from the private sector, and more specifically from a mortgage industry that was out of control….

Between 2004 and 2007, private lenders originated three quarters of all subprime and alt-A mortgage loans. These were loans to financially fragile homeowners with credit scores under 660, well below the U.S. average, which is closer to 700. But only a fourth of such loans were originated by government agencies, including Fannie, Freddie and the Federal Housing Administration.”

Get that? 3/4 of sub prime came from PRIVATE, not public.

But yes I know, haters got to hate.

The dollar amount of subprime and alt-A loans made during this period by the private sector was jaw-dropping, reaching nearly $600 billion at the height of the lending frenzy in 2006….By contrast, government lenders made just over $100 billion in subprime and alt-A loans in 2006.

Comments

You must be logged in to post a comment.